Building Wealth & Securing Legacies

Through Strategic Retirement Planning

Personalized Retirement Strategies

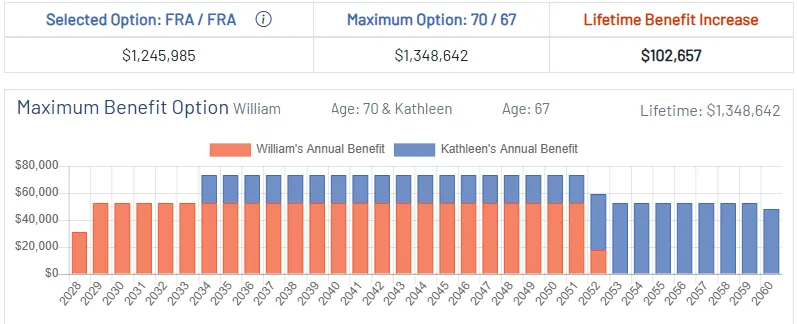

Our tailored retirement strategies help maximize your Social Security benefits and secure income with fixed indexed annuities, providing long-term stability and peace of mind.

Guided Simplicity

Our straightforward approach makes retirement planning easy to understand. We guide you through each step, ensuring clarity and confidence in your decisions.

Trusted Expertise

With years of specialized experience in Social Security and retirement planning, we ensure your financial future is handled with precision and care.

Comprehensive Solutions

Our solutions are tailored to meet your unique retirement goals, integrating Social Security strategies and guaranteed income options for a well-rounded, secure plan.

Who We Are

Your Trusted Partner for Retirement Success

Our mission is to help you achieve a secure and fulfilling retirement with expert Social Security strategies and guaranteed income solutions you can trust.

Personalized Retirement Strategies

Social Security Expertise You Can Rely On

Guaranteed Income Solutions for a Worry-Free Future

10+

Years Experience

Secure Income Solutions

Our income solutions provide stability and ensure a steady income throughout retirement, tailored to your goals.

Value-Driven Planning

Our tailored plans maximize your Social Security benefits and guarantee income with high value and reliability in every step of your retirement journey.

Client-Focused Guidance

Our team provides dedicated, ongoing support to guide you through every step of your retirement planning journey.

What Our Clients Say

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

James Smith

Office Manager

Working with their team has transformed my financial outlook—they truly understand my goals and needs.

Rachel Lee

Office Manager

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

Michael Chen

Office Manager

Frequently Asked Questions

When is the best time to start drawing Social Security benefits?

The optimal time to start Social Security varies for each individual. We assess factors like your financial needs, life expectancy, and retirement goals to help you determine the best time to begin benefits, maximizing your income for a secure retirement.

How can fixed indexed annuities support my retirement income?

Fixed indexed annuities offer a reliable income stream that isn’t affected by stock market fluctuations. They provide growth potential while protecting your principal, ensuring a steady income throughout retirement.

Are annuities safe? I've heard they have limitations and high fees.

Annuities vary widely, and while some types can have high fees or restrictive terms, fixed indexed annuities are designed to prioritize your security and growth. They protect your principal from market risk, and unlike some investment options, they offer stable income with growth potential linked to market performance—without direct exposure. We’re here to provide clarity and transparency, so you can make informed decisions about whether a fixed indexed annuity aligns with your financial goals.

What makes BWRS different from other retirement planning firms?

BWRS takes a holistic approach to retirement planning, focusing on Social Security optimization and secure income through fixed indexed annuities. We provide personalized guidance tailored to each client’s unique needs, backed by over a decade of experience in the Medicare and retirement industry.

How do I know if a fixed indexed annuity is right for me?

Fixed indexed annuities are ideal for those seeking growth potential with protection from market volatility. We’ll review your financial goals, risk tolerance, and retirement income needs to determine if this solution aligns with your plan.

Can BWRS work alongside my financial advisor?

Yes, BWRS partners with other financial professionals to create a cohesive retirement strategy. Our focus on Social Security and income solutions complements broader investment strategies, ensuring your overall financial plan is comprehensive and secure.

Your trusted partner in financial growth and investment success, committed to securing your financial future.

Useful Links

Testimonials

FAQs

Blog